Because clients don’t fit into neat little boxes—so why are we still boxing lenders in?

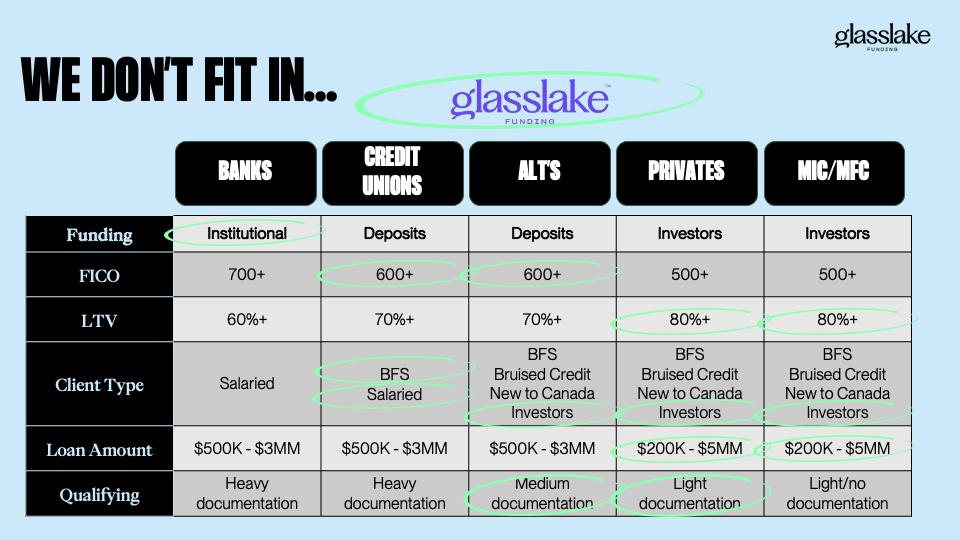

The Canadian lending landscape has been shifting for decades. New players come and go, regulations tighten, client portfolios evolve—honestly, who can keep up? We get it. As the newest name in the game, brokers and their clients aren’t always sure where Glasslake fits in. Truthfully? Neither are we—because we don’t.

So, who (or what) is Glasslake?

Are we private? Alternative? We get asked this daily, even by brokers we work with regularly. So let’s set the record straight:

We’re here to do things differently. And we’re here for the clients that traditional lenders overlook.

We don’t fit in (and that’s the point)

The lending world loves its categories:

- A Lenders (Big 6 Banks) → Low rates, strict requirements, basic deals.

- B Lenders (Credit Unions, Alternative Lenders) → Middle ground, some flexibility, but still rules-heavy.

- C Lenders (Privates/MICs) → High rates, high fees, short terms, more flexibility. ,

And borrowers? They get categorized, too—A, B, or C based on credit, income, and property details. But what about the ones who don’t fit? The self-employed, the high-net-worth, the investors with layered portfolios?

That’s where Glasslake comes in.

A new lending landscape demands a new approach

Liquidity is tight. Regulations are stricter. Canadians are struggling to qualify. Most lenders aren’t built for this level of complexity. But we are.

With ample, institutional funding, low fees, longer terms, longer amortization, flexible qualifying programs, and unique products that help fill the gap in the market – we’re here to bet on Canadians who bet on themselves.

We are redefining lending with non-B-20 institutional funding that puts flexibility first. With no stress test, simple qualifying, and ease of underwriting, we help brokers secure financing for clients who don’t fit the traditional mold.

Glasslake thrives where others won’t.

We’re everywhere, but not for everyone. Not every borrower needs us, but for the right ones, we’re exactly what they’ve been looking for. The seasoned investors scaling their portfolios. The business-for-self clients with layered financials. The developers and builders expanding their projects. The portfolio owners strategically growing their investments. The commercial buyers who don’t think small.

Beyond A, B & C: Welcome to B- Lending

Most lenders play it safe, sticking to predictable deals—traditional mortgages, standard income verification, and cookie-cutter approvals. That’s fine for some borrowers. But not for the ones who actually drive growth.

At Glasslake, we go where the real opportunities are. We structure deals that make sense for clients who don’t fit a checklist. You could call us B- lenders, but really, we’re in a league of our own.

Where traditional lenders see risk, we see potential.

| Borrower Type | Traditional Lenders Say ❌ | Glasslake Says ✅ |

| Self-employed with irregular income | “Doesn’t meet salary requirements” | “Let’s assess the full financial picture” |

| Investor with multiple properties | “Too complex” | “Let’s structure a smart DSCR deal” |

| High-net-worth individual with minimal salary | “Not enough income proof” | “Equity and assets tell the real story” |

| Builder/developer with a mixed-use project | “Doesn’t fit the lender’s box” | “We’ll create a custom hybrid solution” |

Complex income? That’s not a problem. Multiple properties? Bring it on. Non-traditional earnings? We know how to make it work. While others stay surface-level, we help borrowers unlock higher LTV ratios, longer mortgage horizons, and portfolio financing solutions designed for long-term success.

What our borrowers look like

Some borrowers don’t just need financing, they need a lender who actually understands them.

Take the tech founder who built a company from the ground up, has major equity, multiple properties, and a high credit score. On paper, they should be a perfect client, but because their salary is low, traditional lenders won’t touch them. We don’t see just a salary—we see the full financial picture. That’s why we structured a $2.5M commercial mortgage that made sense for their reality, not just a lender’s checkbox.

Or the real estate investor with 12 properties across three corporations. Their portfolio is thriving, but conventional lenders can’t get past the complexity of their corporate structure. Instead of running the other way, we approved a $4.1M mortgage with a higher LTV than the market standard using a DSCR approach—because we actually understand how these deals work.

Then there’s the medical professional who wanted to expand into mixed-use real estate, only to be turned down because the property didn’t fit a lender’s guidelines. It wasn’t risky, it was just different. So we structured a hybrid commercial-residential mortgage for $500K with extended amortization, and a 3 year term, giving them the flexibility to make it happen.

Mid-lending? Not here. Discover the depth of Glasslake.

Most lenders panic when they can’t touch the bottom. We’re built for it. While others see complexity as a challenge, we see it as an opportunity to create solutions that actually work.

We understand sophisticated financial structures, multi-property investors, and business owners with non-traditional income streams. While others stay surface-level, we help borrowers go deeper, unlocking customized financing solutions that truly fit their needs.

Wavemakers. Don’t just ride the wave, be the force that makes them.

We don’t just back brokers—we reward them.

Every deal you close with Glasslake moves you closer to exclusive perks. Fund over a million-a-month with Glasslake, and receive priority service on all your deals for the next month. In addition to lightning-fast service, get access to rate coupons, brand consulting, marketing support, sponsorship dollars, or you can even qualify for our upcoming Luxperience rewards trip. Our perks change month over month, keeping things interesting for our brokers who close deals with us. More than one motivation, more than one reward.

Visit our website and make waves:

https://www.glasslake.ca/wavemakers

Ready to take the leap? Let’s make a deal.

If you’ve got clients who need more than a standard approval, let’s talk. Glasslake’s flexible lending solutions and WaveMakers rewards are here to help you go deeper, close bigger deals, and reshape the lending landscape.